Monte Carlo for the Masses - 5.5 Billion Potential Users and Counting

by Dr. Sam L. Savage

Do you want to read about it or do it? To go straight to the demo, click the image below, otherwise, continue reading.

The Chance Economy

A few chance-informed industries have been around for centuries.

• Banking is governed by the Chance that all customers will withdraw funds simultaneously.

• Fire Insurance is governed by the Chance that all insured houses will burn down at once.

• Investments are governed by the Chance that a portfolio will lose money.

As such, these industries would not survive without explicitly accounting for uncertainty through elaborate probabilistic calculations or simulations.

Of course, all businesses face uncertainty, yet this is rarely reflected in managerial dashboards. Instead, most industries succumb to replacing uncertain assumptions with single number averages, leading to a class of systematic errors I call The Flaw of Averages.

The Chance Economy Dividend

The Flaw of Averages ensures that most projects are Behind Schedule, Beyond Budget, and Below Projection. Some large projects in industries beyond those above are beginning to take a chance-informed approach to management.

• Behind Schedule

Clinical trials of new pharmaceuticals are governed by laws of Chance that dictate that they are more likely than not to be behind schedule. Addressing this up front allows options to be put in place to accelerate the trials if needed. The economic dividend of getting to market a few months earlier can be on the order of $100 million.

• Beyond Budget

Firm Fixed-Price contracts can leave the contractor exposed to huge risks in the face of cost uncertainty. There is a dividend to understanding the tradeoffs between the Chance of winning a bid vs. Chance of losing money because your bid was too low.

• Below Projection

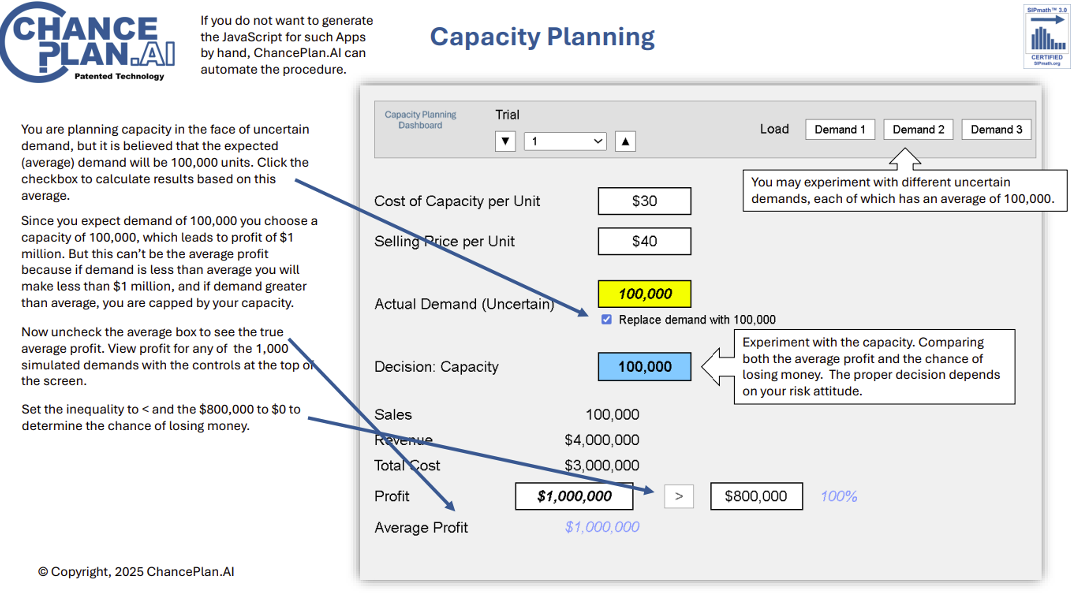

In developing capacity for a new product or service, it is common to plan for the Average demand. This ignores the fact that your upside is limited by your capacity. There is always a tradeoff between Average profit vs. Chance of loss. Depending on the economics of the situation and the organization’s risk attitude, the correct capacity me be significantly greater or less than the average demand.

In an uncertain world, Chance must not be ignored. But go ahead, look at the dashboards in your organization. Some may show an occasional graph of a probability distribution, but these just tend to trigger Post Traumatic Statistics Disorder (PTSD) in most managers. Can you actually find a dashboard that displays the Chances associated with achieving key performance metrics?

This is about to change.

Uncertainty as Auditable Data

In an approach inspired by the financial engineers of the late 1980s, the discipline of probability management stores uncertainties as arrays of possible outcomes called SIPs (Stochastic Information Packets). Today 501(c)(3) nonprofit ProbabilityManagement.org has revolutionized this approach through its Open SIPmath™ Standard that embeds the results of complex simulations into data that may be interpreted in Excel, Python and R.

AI can Deliver Chance to Every Dashboard

Recently, aided by advances in Artificial Intelligence, I founded ChancePlan.AI to commercialize applications of the SIPmath Standard. In particular, we have focused on developing Web Apps that run directly in the browser with nothing but JavaScript. This is a low powered computational environment, in which it would be difficult to develop complex simulations. But using the SIPmath Standard, the heavy number crunching gets performed elsewhere and is delivered to the Web App, much as electricity generated in a distant power plant is delivered to your light bulbs and dishwasher using the 60 Cycle Alternating Current Standard. This puts the benefits of Monte Carlo Simulation within reach of the 5.5 billion people on the internet.

Take Them for a Test Drive

Below are brief descriptions of the Apps published at ChancePlan.AI. A test drive is just a click away.

Copyright © 2025 Sam L. Savage